What is Reporting Currency?

A reporting currency is a financial reporting entity associated with a ledger. The reporting currency has the same chart of accounts and accounting calendar as the ledger, but usually has a different currency. To maintain ledger transactions in multiple currencies, we use reporting currencies and are additional currency representations of primary or secondary ledgers. Reporting currencies can be used for supplementary reporting purposes, such as consolidation or management reporting. The term Reporting Currency refers to subledger or journal-level reporting currency, rather than balance-level reporting currency. Financial reporting can be performed using the ledger currency or any of the reporting currencies. When we enter journals in General Ledger, they are converted into the ledger currency and each of the reporting functional currencies. We can inquire and report on transactions and account balances in reporting currency by logging onto a responsibility that has access to the reporting currency.

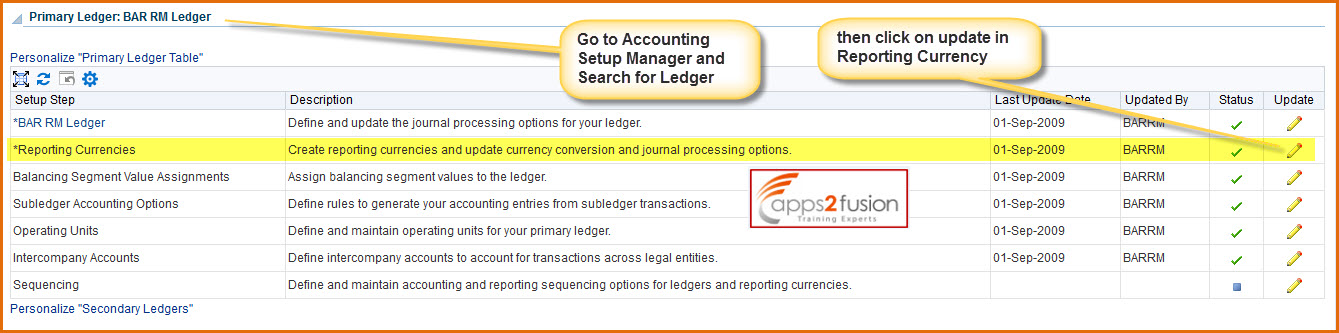

1.

2.Click on Add Reporting Currency

3.Enter the required information & click on Apply

When to use Reporting Currencies

Reporting currencies are intended for use by organizations that must regularly and routinely support statutory and legal reporting of both transactions/journals and General Ledger account balances in multiple currencies--other than the ledger currency. If we only need to report account balances in a currency other than your ledger currency, we can use General Ledger translation. To use reporting currencies, we must define reporting currencies for ledger in Accounting Setup Manager.

Reporting currencies are not intended as a replacement for the General Ledger translation function.

Reporting currencies can be maintained at the following currency conversion levels:

- Balance Level

- Journal Level

- Subledger Level

In 11i

If it is Balance level then it can be achieved by using Translation process and generate Trial balance in reporting currency. Details level information such as Subledger or Journal would be achieved through Multi reporting Currency (MRC). Reporting Currency Functionality in R12 is combination of both MRC and Reporting currency in 11i.

In AX Countries (France, Italy, Greece, Portugal, Spain, Austria) there is a concept called Dual posting, where we can enter in Global chart of Accounts and post in Local COA. But this is only required for the following Subledgers-

- Oracle Inventory

- Oracle receivables

- Oracle Payables

For all other modules in 11i we need to use consolidation process to transfer the date from entered to Reporting COA.

In R12

This functionality can be achieved through secondary Ledger where we can have different COA than the Primary Ledger and with help of SLA we achieve all the statutory requirement for the organization. This feature in R12 is available for almost all modules like AP, AR, FA, GL, etc. Secondary ledgers can be used to represent Primary Ledger's accounting data in another accounting representation that differs in one or more of the following from the Primary Ledger:

- Chart of accounts

- Accounting calendar/period type combination

- Currency

- Subledger accounting method

- Ledger processing options

When to Use Secondary Ledger

If a legal entity must perform corporate and statutory reporting, we can use the Primary Ledger to satisfy corporate reporting requirements and then use a Secondary Ledger to satisfy statutory reporting requirements. If a legal entity is a subsidiary of a parent company and must produce its financial results according to the parent company's reporting requirements in addition to its own local reporting requirements, then a secondary ledger may be used to satisfy the additional reporting requirement.

Secondary ledgers can be maintained at the following data conversion levels-

- Balance level secondary ledger

- Subledger level secondary

- Journal level secondary ledger

- Adjustments Only Secondary Ledger

Difference between Reporting Currency and Secondary Ledger

Reporting currency is used only when the Currency of Primary Ledger need to be changed for reporting purpose. This can be used to capture the information in reporting currency at Balance level, Subledger level and Journal level. Secondary Ledger could be used when we need to change the Chart of Accounts and Accounting convention method to meet the statutory and corporate requirements. This is used primarily where the organization need to report in different authorities like Local authorities, US GAAP,IFRS,IASB etc.

Translation versus Reporting Currencies

General Ledger's translation feature (balance level reporting currency) is used to translate amounts from Ledger currency to another currency at the account balance level. Reporting currencies convert amounts from your transaction currency to a reporting currency at the transaction or journal level. Reporting currencies are specifically intended for use by organizations that must regularly and routinely report their financial results in multiple currencies. As stated earlier, Reporting currencies are not intended as a replacement for General Ledger's Translation feature.

Another benefit of reporting currencies over General Ledger's Translation feature is that with reporting currencies, we can inquire and report on transaction amounts directly from your subledgers. Translation only applies to General Ledger - it cannot be used to translate transaction amounts in subledgers.

Currency Concept and Different Ledgers

|

Functional Currency |

Organization’s functional currency which can be different from the ledger currency that is assigned to primary and secondary ledgers. |

|

Ledger Currency |

Currency assigned to a ledger, such as the primary ledger or secondary ledger, and represents the base currency used to record transactions and maintain accounting data for legal reporting. |

|

Reporting Currency |

Currency other than ledger currency, for which we need to report and shares the same chart of accounts and accounting calendar as the source ledger (either the primary ledger or secondary ledger), but typically uses a different currency. Reporting currency allows to report in a different currency than that of primary or secondary ledger. |

|

Primary Ledger |

Primary ledger acts as the main, record-keeping ledger and uses a particular chart of accounts, accounting calendar, currency, and subledger accounting method |

|

Secondary Ledger |

Optional, additional ledger associated with the primary ledger for an accounting setup and is used to represent the primary ledger's accounting data in another accounting representation that differs in one or more of the following from the primary ledger- |

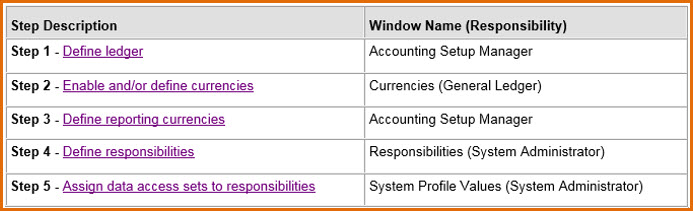

Below are the required steps to set up reporting currencies in the applications .

Comments

RSS feed for comments to this post