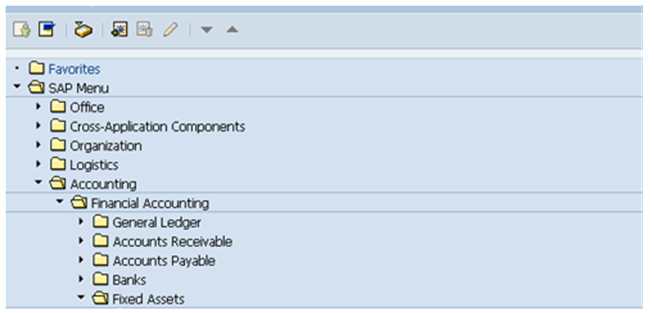

In Books Keeping General Ledger plays a vital role. Likewise, in SAP FINANCIALS General Ledger Accounting is one of the most important sub-modules. There are various processes, functions and reports in GL Accounting specifically useful for GLs. The SAP screen has a common tree structure for all its sub-modules on the SAP EASY ACCESS SCREEN to maintain uniformity and find a Transaction code faster. The image below is what it will look like:

The further selection will lead you further in to the selection screen of the sub module to be worked upon. The Various functions performed in General Ledger Accounting are as mentioned below; let’s see the transaction of each of them.

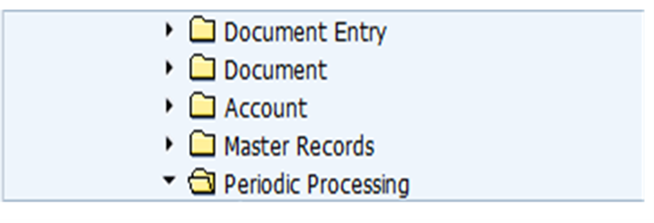

The functions under the heads would be as under:

- Document entry: The General ledger Postings to the GL (Accounting entries) are to be posted under this menu path. This will open the transaction code for the document entry. Multiple transactions are provided to facilitate different kinds of entries.

- Document: Document display, document change, multiple document overview, among others, can be done under this head.

- Account: Account display single/multiple, Account Clearing, and so on.

- Master Data: GL Master Creation, deletion, blocking, and so on.

- Periodic Processing: Account clearing, reports, periodic closing, etc.

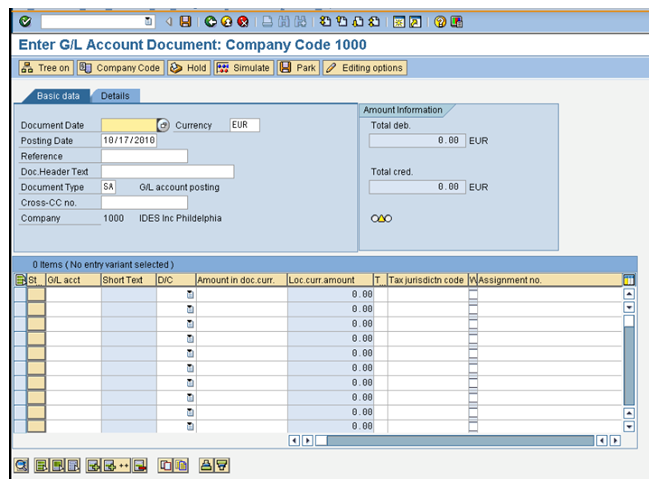

Document entry Screen:

The document entry in SAP FI is posted in the screenshot given below by all the necessary entries of the fields mentioned below. Each field has its own reason and utility, be it document tracking, reporting, and so on.

General Ledger Master Data:

Let us understand a very important concept in General Ledger accounting in SAP, called a CHART OF ACCOUNTS.

CHART OF ACCOUNTS: The chart of Accounts is a variant in SAP which consists of the structure and the basic information about general ledger Accounts. Variant in SAP means it is at client level and can be used multiple times (like a template). A Chart of Accounts can be assigned to various company codes of a client, which require the same structure with modification to customize as per the requirement of the Company Code. So all the GL accounts in the Chart Of Accounts to be used need to be activated in the Company Code segment for using the GL in the particular Company code.

Defining a Chart of Accounts: To define a chart of accounts the customizing needs given below must be done in SAP -

- Chart of Accounts key

- Description

- Language

- Length of the GL Account Number

- Manual Automatic creation of Cost Elements

- Group Chart of Accounts

- Blocked Indicator

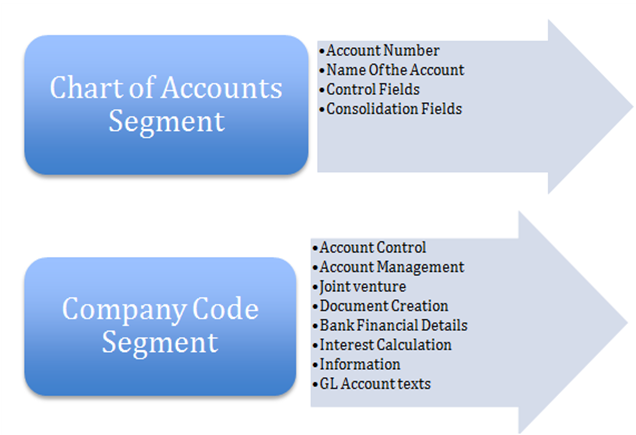

General Ledger Master Data Account has two segments:

- Chart Of Accounts Segment

- Company Code Segment

The above settings are done in different tabs in the GL Account Master Data Creation. The Information may be customized company code segment. According to its usage the following information can differ for different company codes -

- Currency

- Taxes

- Reconciliation Account

- Line Item Display

- Sort Key

- Field Status Group

- House Bank

- Interest Calculation Information

TYPES OF GENERAL LEDGER ACCOUNTS

In the Chart of Accounts whether an account is a Balance Sheet Account or P&L Account is to be specified.

Balance sheet GLs Account balances are transferred to the same Balance sheet GL account.

P&L Accounts Balances are transferred to a retained earnings account.

ACCOUNT GROUPS.

Since chart of Accounts contains many different types of Accounts they can be grouped in different Account Groups. For example, Cash Accounts, Material Accounts, Asset Accounts, and so on.

Another very important type of GL Account is called a Reconciliation Account

RECONCILIATION ACCOUNTS

Reconciliation Accounts are general ledger accounts assigned to the business partner master records to record all transaction in the subledger. All the posting to the subledgers are automatically posted to the assigned reconciliation accounts (it is done in real-time).You define the GL accounts as reconciliation accounts by entering one of the following account types. Typical Account types would be Accounts Receivable or Accounts Payables. You cannot post an entry directly to a reconciliation Account.

Creation of General Ledger Accounts can be done for a company code:

Manually:

- One step - Create both segments centrally

- Two steps - First create the Chart Of Accounts segment, then create the Company code segment.

Copying

- Copy Single GL Account

- Copy Entire Chart of Account segment

- Copy Entire Company Code Segment

Data Transfer

- Data transfer from an external system

PERIODIC PROCESSING:

The periodic Processing in GL Accounting would consist of the various processes mentioned below:

Document Clearing

Reporting

Balance Transfer

Exchange Rate Difference Postings

And other processes in accordance to an organization.