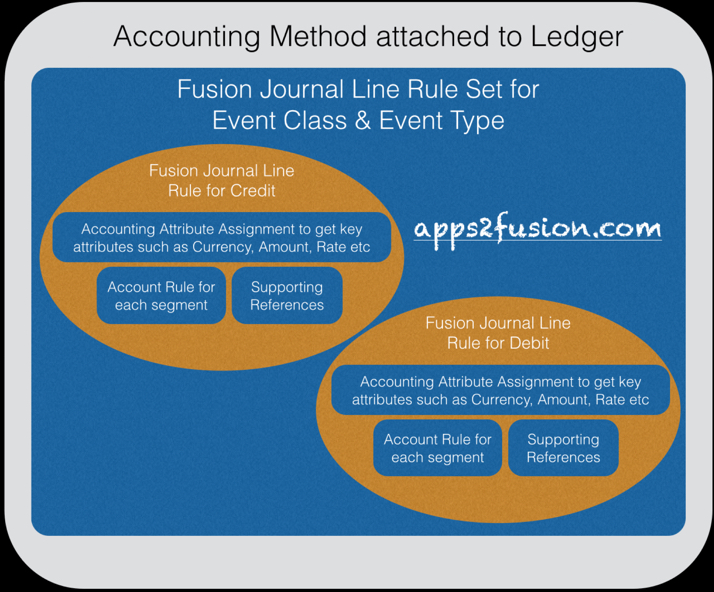

Every journal in Fusion Financials needs a line for credit and a line for debit, at least one credit and at least one debit. The journal line rule configuration determines how each debit and credit entry will be created. Basically the configuration in Journal Line rule constructs the credit or debit lines. For the simplicity of this discussion, let us not discuss the gain/loss option when defining Journal Line Rule.

Relationship between database staging table and Journal Line Rule in Oracle FAH

To create a journal line, you need data, and that data for Fusion Accounting Hub will be in your staging tables. The staging table itself will be registered as a source in Fusion Accounting Hub. Every column in the staging table’s view will be a source. Some source columns are special columns and those are classified as accounting attributes. These are the columns which give you your amount, currency, line number etc, which are the key elements of a journal line. The accounted amount can either be calculated or be used as is from the staging table. When accounted amount and code combinations are used as is from the staging table, then it is call pass through accounting in Financial Accounting Hub.

What are the accounting attributes?

Every journal line rule belongs to an accounting event classes such as Invoice, Investment Trade etc. The event type is the nature of action against the event class, i.e. Invoice Creation, Invoice Validation, Invoice Cancellation, Trade Initiation, Trade revaluation etc. You will define a journal line for either an event class level( for all event types ) or for a specific combination of Event Class and Event Type.

The image above shows pictorial representation of Journal Line Rule in Oracle Fusion Accounting Hub.

When creating a journal line rule, accounting attribute assignments are automatically defaulted from the configuration you did when defining the event class. You can override this default by mapping other columns to the accounting attributes.

Defining the conditions in Oracle FAH journal line rule

You can also define conditions that determine if & when the journal line should be created for a record in staging table.

Think of these as simple IF THEN ELSE Conditions.

These conditions are used to restrict the use of a journal line rule by controlling when a particular journal line rule is used by the Create Accounting process. For example, generate a tax accounting line if there is a greater than zero value in tax amount field. The journal line is only created if the conditions attached to it are evaluated as boolean true. If the conditions evaluate to true, the line rule is used to create a subledger journal entry line.

Reducing the data footprint in FAH Accounting

Sometimes you may want to reduce the data footprint, in which case you can use the option for Merge Matching Lines option.

This option will group the journal lines within each journal. Lines are only merged if they share the same account combination, description, supporting reference values, and accounting class. Please note that accounting class is for reporting purposes to classify journal entry lines. For example, a line used to record the collection of cash would typically have an accounting class of Asset.